“Revenue sharing,” a fee-for-service arrangement between investment companies and retirement plan service providers, is attracting the attention of retirement plan sponsors. As ERISA fiduciaries to a retirement plan, employers must understand how revenue sharing arrangements affect their plan fees. Against the backdrop of a growing number of lawsuits alleging that fiduciaries breached their duties by allowing excessive plan fees to be paid from plan assets, many plan sponsors are reviewing their plan’s fees, including revenue sharing arrangements.

What Is Revenue Sharing?

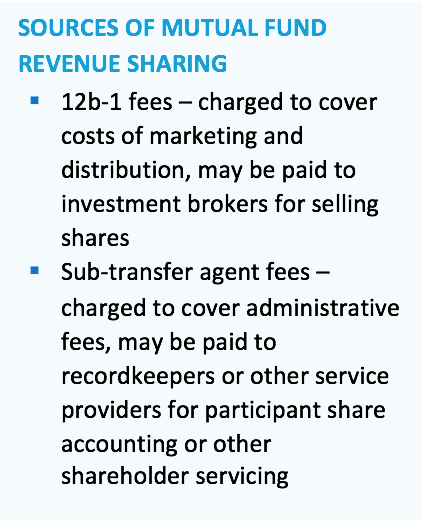

Revenue sharing typically refers to the compensation plan recordkeepers and service providers receive from mutual fund companies (or investment managers, affiliates, etc.) in exchange for assuming part of the mutual fund company’s administrative functions. For example, recordkeepers usually track share ownership of each fund for each plan participant in a participant-directed plan (e.g., 401(k) or 403(b) plan). In exchange for these services, the recordkeeper could receive a portion of the fees the fund company charges to individual investors. These fees are included within a fund’s expense ratio. A single mutual fund may have multiple share classes with different levels of advisory or shareholder services. This would result in different expense ratios and different revenue sharing for the various share classes.

What Are the Fiduciary Responsibilities of Revenue Sharing?

Under the Employee Retirement Income Security Act of 1974 (ERISA), plan fiduciaries must act prudently and solely in the interest of plan participants and beneficiaries. When managing plan assets and plan administration, they should follow strict codes of conduct. These high standards are especially important when selecting and monitoring service providers and investment vehicles. Plan sponsors must ensure that only qualified service providers provide services to the plan. Furthermore, they should verify that the compensation arrangements with such providers are reasonable and necessary if paid from plan assets. Plan sponsors must disclose plan fees to plan participants annually. If sponsors are using revenue sharing to pay a portion of the plan fees, they must disclose this to participants quarterly.

There are consequences if a plan sponsor does not fulfill its fiduciary responsibilities related to managing plan fees. The Department of Labor (DOL) has the authority to enforce the requirements through fines and other legal actions. Additionally, plan participants have the right to initiate lawsuits against plan fiduciaries.

How Are Fees Managed in Revenue Sharing?

Plan sponsors can pay fees for plan services directly or from plan assets. Certain fees may also be paid indirectly through revenue sharing arrangements. Say a plan sponsor has selected investments that pay revenue sharing. The plan sponsor must understand how those dollars factor into the fees assessed against the plan. This knowledge is vital in order to make a prudent decision regarding fees charged by the service provider. Are the fees reasonable? For example, if a recordkeeper is receiving revenue sharing, the plan sponsor must understand how those dollars are offsetting or reducing total recordkeeping costs. Otherwise, the plan sponsor pays these directly or debits them from plan assets.

Furthermore, recordkeepers can administer revenue sharing in a variety of ways. Some recordkeepers will maintain a ledger for each plan. By doing this, they offset (reduce) their fees dollar-for-dollar based on the amount of revenue sharing received from investment providers. In other cases, they deposit revenue sharing into an account within the plan. Then, the plan fiduciaries can decide how they will use revenue sharing dollars. For example, used to pay recordkeeping fees or purchase additional plan services.

Start Here

So, as you are evaluating the reasonableness of fees charged to your plan, include any revenue sharing arrangements. Here are some things to consider:

- Have you received and reviewed fee disclosures from recordkeepers, third-party administrators (TPAs), investment advisors, investment providers, and other service providers to the plan?

- Did you drill down to determine all the direct and indirect fees charged to the plan?

- Have you benchmarked those fees against the fees charged by other service providers?

- Have you benchmarked your total plan fees against total fees paid by other plans of a similar size and service level?

- Are there different structures of pricing that would benefit the plan?

- Would it be prudent to add or replace investment alternatives with lower cost options?

- Have you documented the decision-making process?

Finally, this analysis can be time-consuming and complex, but the consequences of failing to meet ERISA’s fiduciary standards can be significant. Even more, plan sponsors look to their plan’s financial advisor to help them manage the important fiduciary duties of analyzing and monitoring revenue-sharing fees and arrangements.