In life, there are few win-win propositions, but for employers who sponsor a 401(k) plan that allows plan participants to direct their own investments, choosing a Qualified Default Investment Alternative (QDIA) can benefit both the employer and the plan participants.

ERISA Requirements for Plan Sponsors

The plan fiduciary (typically the employer sponsoring the plan) has many responsibilities in managing plan administration. They must meet the high fiduciary standards required by ERISA. When it comes to choosing a menu of plan investment alternatives, plan sponsors must

- Prudently select and monitor the plan’s investment alternatives

- Act solely in the interests of participants and beneficiaries

- Diversify investments to protect against the risk of large losses

- Ensure that only reasonable fees are paid from plan assets

- Designate a default investment for those who fail to select their own investments

- Document their due diligence process for making investment decisions

Plan advisors can provide valuable support to plan sponsors by delivering education on these fiduciary requirements. Furthermore, they need to evaluate and benchmark investment options and expenses.

Liability for Investment Performance

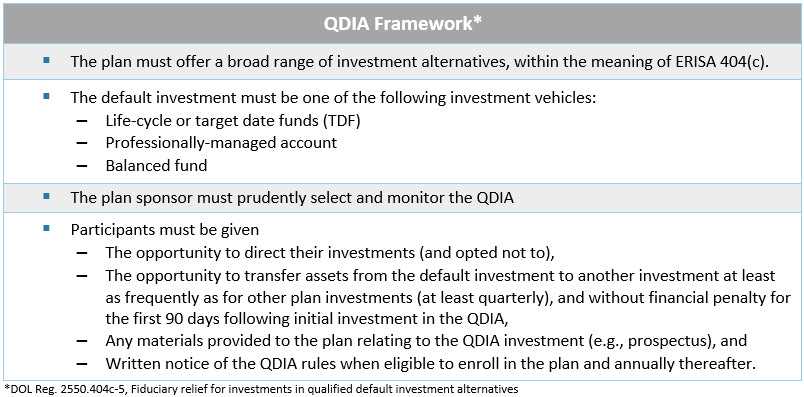

In most retirement plans, participants are responsible for deciding which investments to purchase with their plan balance. They choose from the list of alternatives selected by their employer. ERISA provides a framework to relieve plan sponsors of liability for the investments selected by participants if the plan meets the requirements set forth in ERISA Section 404(c) (e.g., offering a broad range of investment options with materially different risk/return characteristics).

However, if a participant does not make investment choices, their account balance will be invested in a default investment chosen by the plan sponsor. This fiduciary protection under ERISA 404(c) does not apply when participants fail to select their own investments.

QDIA Benefit Plan Sponsors

To protect against the fiduciary liability for a poor performing default investment, plan sponsors historically selected a low-risk investment as the plan’s default investment. Congress became concerned with this approach. Why? These investments are not always suitable for long-term investing. Due to the increasing popularity of automatic enrollment, more and more participant assets are landing in the default fund and staying there long-term. To encourage plan sponsors to select a default investment more appropriate for long-term savings and provide fiduciary relief with respect to selecting default investments, Congress created the QDIA safe harbor.

If an investment meets the QDIA requirements, the default investment is deemed to be a prudent investment. Consequently, the plan sponsor will be relieved of fiduciary liability for the performance of the default investment.

QDIAs Benefit Plan Participants

In addition to providing fiduciary protections for plan sponsors, QDIAs can result in improved outcomes for participants who default into a QDIA.

The target date fund (TDF) QDIA option, for example, contains an underlying mix of investments. These are diversified and automatically adjusted on behalf of the investor to become more conservative as the selected target retirement date approaches. Managed accounts adjust over time to align with the investment objectives set by the investor. Investments like these offer participants a one-stop shop to obtain the benefits of professional portfolio management. Therefore, they don’t have to rely on themselves to research and select investment options appropriate for their age, risk tolerance, and retirement income goals. Even more, they won’t have to remember to monitor and rebalance their account periodically.

Start Here

Finally, plan sponsors can seek the assistance of a retirement plan advisor to learn about the benefits of a QDIA and compare the options that may be appropriate for the plan and its participants.

- Determine whether the plan’s current default investment meets the QDIA requirements.

- Review the percentage of participants’ assets currently allocated to the plan’s default investment.

- Benchmark and compare a variety of QDIA options (e.g., proprietary TDFs vs. custom TDFs vs. managed accounts) to determine the best fit for the plan.

- Document the due diligence process followed in analyzing QDIA options and selecting the plan’s default investment.