Each year in October, the IRS announces the cost-of-living adjustments (COLAs) that will apply to retirement plan contribution limits and other thresholds for the following calendar year. Any change to the contribution limits requires adjustments in payroll systems and internal procedures designed to make sure plan contributions stay within the allowed limits.

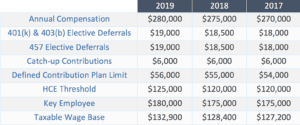

This chart provides the limits for 2019 and illustrates how the limits have changed over the past few years for defined contribution plans. In some years, the changes in the cost-of-living index does not meet the statutory thresholds that trigger increased limits.

2019 COLA INCREASES*

*You can find the complete IRS COLA Increase Table at

https://www.irs.gov/retirement-plans/cola-increases-for-dollar-limitations-on-benefits-and-contributions

Explanation of Plan Limits

Following is refresher for plan sponsors on how the annual limits affect plan operations.

Annual Compensation (a/k/a Compensation Cap) – Only a certain amount of a plan participant’s compensation may be used to calculate contributions or to perform nondiscrimination tests. For example, for 2019, if a participant earns $300,000 in compensation, the employer may only calculate the participant’s share of a profit sharing contribution based on $280,000 – the annual compensation limit in effect for the year.

Elective Deferrals – A participant’s salary deferrals (pre-tax and Roth) made to 401(k) and 403(b) plans cannot exceed $19,000 for 2019, plus catch-up contributions. Participants who also participate in a governmental 457(b) plan have a separate deferral limit of $19,000 for that plan.

Catch-Up Contributions – 401k), 403(b) and governmental 457(b) plan participants age 50 or older may defer an additional $6,000 each year over the elective deferral limit. 403(b) plans and governmental 457(b) plans may have additional special catch-up provisions.

Defined Contribution Plan Limit (a/k/a Annual Additions Limit) – All employee and employer contributions allocated to a plan participant’s account for 2019 cannot exceed the lesser of:

- 100% of the participant’s compensation, or

- $56,000, plus catch-up contributions.

HCE Threshold – An HCE (highly compensated employee) is an employee who:

- Owns more than 5% of the employer at any time during the year or preceding year, or

- Earned more than $125,000 for 2019 from the employer and, if the employer elects, had compensation that ranked the employee in the top 20% of all employees.

HCE status is used to determine how employees are categorized for the 401(k) plan nondiscrimination tests: the Actual Deferral Percentage (ADP) test and the Actual Contribution Percentage (ACP) test. The ADP test limits the percentage of compensation the HCE group can defer into the 401(k) plan, based on the deferral rate of the nonhighly compensated employee (non-HCE) group. The ACP test ensures that the employer matching contributions and after-tax employee contributions contributed for HCEs are not disproportionately higher than those for non-HCEs.

Key Employee – A key employee is an employee who

- Owns more than 5% of the employer,

- Owns more than 1% of the employer and has annual compensation of more than $150,000, or

- Is an officer of the employer and has compensation of more than $180,000 (for 2019).

Key employee status is used to determine how employees are categorized for the top-heavy test, which measures whether plan assets are concentrated in the accounts of business owners or officers of the company earning a certain amount of compensation. A plan is top-heavy if more than 60% of its assets are held in the accounts of key employees. The determination is made as of the last day of the preceding plan year (December 31 for a calendar-year plan). If the plan fails the top-heavy test as of December 31, 2018, it will be considered top-heavy for 2019 and the employer may be required to make a contribution for non-key employees.

Taxable Wage Base – The taxable wage base is the maximum amount of an employee’s compensation that is subject to Social Security tax. This limit is also used when allocating certain employer contributions in retirement plans that use the permitted disparity contribution formula (also known as Social Security integration).

Start Here

Plan advisors, record keepers, and third party administrators (TPAs) are among the best resources to help plan sponsors understand how their plan may be affected by the annual COLA adjustments. Plan sponsors may want to

- Review the COLAs each year with their internal payroll staff or outsourced payroll company to make sure all necessary adjustments are made and confirm the correct definition of compensation is being used for plan operations.

- Analyze last year’s nondiscrimination testing results to determine whether changes to the groups of employees classified as HCEs or key employees could affect this year’s tests. A plan advisor can help explore plan design changes (e.g., safe harbor 401(k) plans) to prevent failed testing in the future.