Many retirement plan participants are thankful their employer’s retirement plan allows them to borrow from their savings before retirement and – if all goes according to plan – repay the loan back into their account. The tax laws permit these plan loans, so long as certain regulatory requirements are met. Employers must follow these rules to properly issue a loan and oversee the repayment process. Multiple people are typically involved in this administrative process, from calculating the maximum loan amount, to withholding the proper repayment amounts from payroll. Despite everyone’s best efforts, mistakes happen.

If a loan program is not operated in compliance with the tax rules, there can be consequences for both the loan recipient and the plan. To keep their loan programs in compliance and ensure that participants’ retirement savings continue to accumulate tax-deferred, employers who discover loan errors in their plan may apply to the IRS to correct those errors. The IRS has recently updated their correction methods to make it easier and less expensive for employers to correct common plan loan mistakes.1

Loan Rules Refresher

Plan loans must meet the following regulatory requirements to avoid being treated as a taxable distribution from the plan.

- Enforceable written loan agreement

- A commercially reasonable interest rate

- Substantially level repayments made at least quarterly

- Repaid within five years (exceptions for primary residence loans and certain leaves of absence)

- Maximum loan amount is the lesser of 50% of participant’s vested account balance, or $50,000 (further reduced if participant has outstanding loans within 12 months prior to the loan)

If a loan does not satisfy these requirements, the loan is in default. The outstanding loan balance will be deemed distributed, reported on IRS Form 1099-R, and taxable to the participant (excluding basis). For more information on the 401(k) plan loan rules, see the 401(k) Loan Rules Refresher blog.

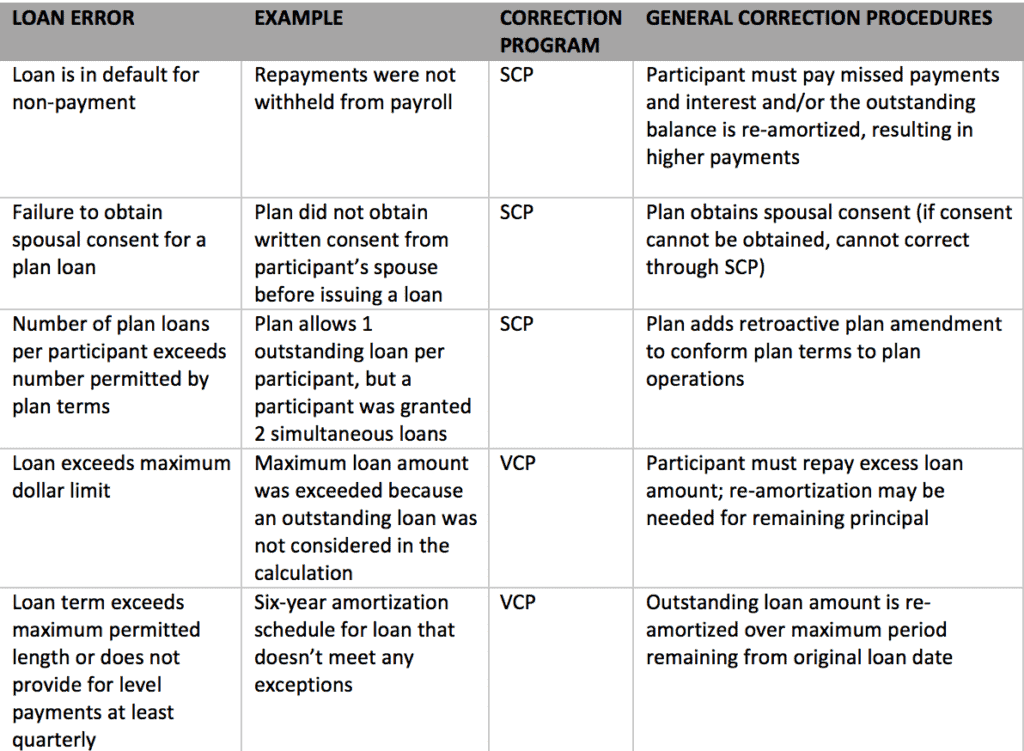

Correcting Plan Loan Errors

If a loan error has occurred, the employer must use one of the programs under the IRS’s Employee Plans Compliance Resolution System (EPCRS) to correct the mistake. Correction of the loan error may avoid a deemed distribution for the participant. Effective April 19, 2019, employers may use the Self-Correction Program (SCP) to self-correct certain plan loan failures without contacting the IRS or paying a user fee. Other types of loan failures must still be corrected under the Voluntary Compliance Program (VCP). To correct under the VCP, the employer must submit a VCP application with supporting documentation and pay the applicable fee. The fee is generally based on the amount of plan assets, and ranges from $1,500 to $3,500 for 2019. If the submission includes all the necessary information and the IRS approves the proposed correction procedures, the IRS will issue a compliance statement that it will not disqualify the plan for the disclosed failures so long as the correction procedures are completed within 150 days.

Start Here

Employers can help avoid plan loan mistakes by developing procedures for

- Determining the maximum loan amount during the loan approval process (must consider plan terms, the participant’s account balance and prior loan history)

- Ensuring a written, enforceable loan agreement is executed for each loan and spousal consent is obtained, if applicable

- Administering a cure period, which allows a window of time to obtain a missing payment before default is triggered

- Obtaining documentation for exceptions to loan term rules (e.g., for military service)

- Ensuring timely repayments (e.g., communicating to the payroll service provider to withhold the loan repayments and the amounts)

1 IRS, Expanded Self Correction Program, EPCRS Rev. Proc. 2019-19, https://www.irs.gov/retirement-plans/expanded-self-correction-program-epcrs-rev-proc-2019-19