Plan sponsors engage a record-keeper or third party administrator (TPA) to help them manage their 401(k) plans. However, the plan sponsor is still responsible under ERISA for overseeing operations. They’re also responsible for making certain the plan is consistent with the terms of the plan document. This includes authorizing distributions. Plan sponsors must understand the distribution rules for their 401(k) plans to avoid costly operational errors under the tax laws.

401(k) Withdrawal

Retirement plans restrict plan participants from using their savings before retirement. To access their 401(k) accounts, participants first need to have a “distribution triggering event.” Each plan document will specify the triggering events chosen by the plan sponsor from the list permitted in the tax laws. A plan must permit distributions when a participant terminates employment after attaining normal retirement age and when they terminate the plan. The law puts greater restrictions on withdrawals from 401(k) contributions made by plan participants as compared to other types of contributions. Employee salary deferrals and designated Roth contributions may only distribute upon:

- Termination of employment

- Death

- Disability

- Attainment of age 59½

- Hardship

- Plan termination

The tax laws also dictate when participants must begin making withdrawals from 401(k) accounts. This is to ensure that the tax-deferred savings enter the tax stream during their retirement. Participants generally must begin taking required minimum distributions (RMDs) the year they reach age 70½. If a participant is still working beyond age 70½, some plans permit the participant to delay RMDs until the participant retires. This delayed RMD option is not available if the participant owns more than 5% of the company.

Taxation

A person pays taxes on a 401(k) plan distribution depending on the types of contributions the person makes.

- Pre-tax salary deferrals and employer contributions – Pre-tax salary deferrals and employer contributions are tax-deferred contributions. This means the participant does not include the money in taxable income in the year they contribute it to the plan. Additionally, any investment earnings that accrue on these contributions are not taxed so long as they remain in the plan. When a participant takes a distribution of these pre-tax contributions and earnings, the participant must include the distribution amount in their taxable income for the year.

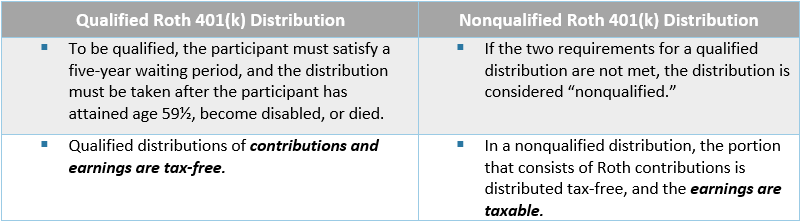

- Roth contributions – If a plan allows participants to make designated Roth contributions, these contributions are made with participant dollars that have already been taxed. Investment earnings are tax-deferred. The taxation of a Roth distribution depends on whether it’s a qualified or a non-qualified distribution.

10% Early Distribution Tax

To further discourage people from depleting their 401(k) savings before retirement, the tax laws apply a 10 percent early distribution tax to taxable distributions taken before the plan participant reaches age 59½. This tax is in addition to the ordinary income tax rates that apply and individuals pay when they file their tax return. There are some exceptions that permit a plan participant to take distributions prior to age 59½ without the additional 10% tax.

Income Tax Withholding

Federal income tax withholding rules apply to 401(k) plan distributions, and some states also require withholding income tax. The plan sponsor and the entity making the distribution are responsible for withholding the appropriate amount from each distribution.

If a distribution is eligible to be rolled to another retirement plan or IRA, 20% of the taxable portion that will be paid directly to the participant is withheld and remitted to the IRS. The plan sponsor must provide a distribution notice to the participant explaining both the taxation and withholding requirements and the distribution options. No withholding applies if a participant directly rolls over a distribution to another eligible retirement plan.

Access to Savings While Still Employed

Many 401(k) company plans allow plan participants to access their savings before they experience a triggering event. For example, most 401(k) company plans allow participants to take 401(k) loans from their plan accounts. Many plans also permit “in-service” distributions in the event of a financial hardship. These distributions are taxable to the extent they consist of pre-tax assets. They are subject to the 10% early distribution tax if the participant is under age 59½ and no exception applies. 401(k) company plans don’t have to offer these options, but plan participants typically value these distribution features.

Start Here

A plan advisor can help plan sponsors understand their responsibilities for authorizing plan distributions and ensuring compliance with the tax laws and the plan’s distribution provisions.

- Review plan document to understand all triggering events and distribution options.

- Facilitate discussions between plan sponsors and their record-keepers and/or TPAs. Ensure the plan sponsors understand the process for approving distributions and managing the payout process.

- Monitor loan activity to evaluate whether loan defaults are resulting in leakage of plan assets.